AEW Capital ups stakes in Healthpeak, Alexandria; drops Boston Properties

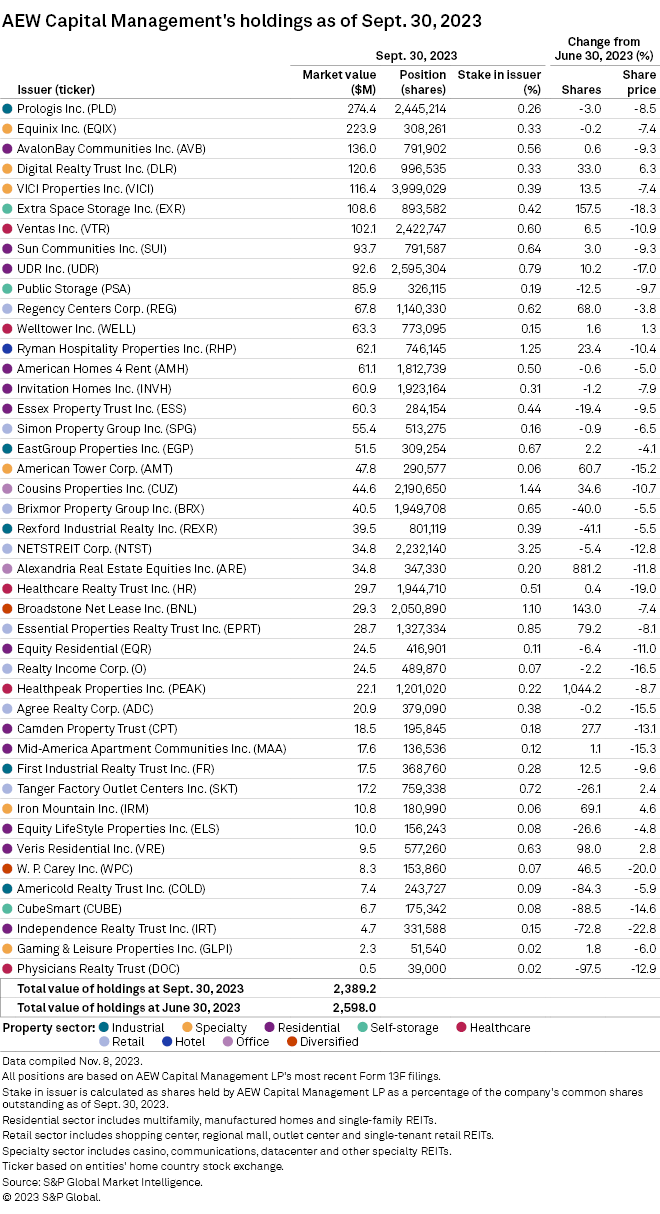

AEW Capital Management LP shuffled its positions in the third quarter.

The Boston-based asset manager significantly boosted its stakes in healthcare real estate investment trust Healthpeak Properties Inc. and in office REIT Alexandria Real Estate Equities Inc. as of Sept. 30 after deeply slashing its holdings in the two companies in the second quarter.

Conversely, AEW unloaded all of its shares in office REIT Boston Properties Inc., worth $43.3 million, and self-storage REIT Life Storage Inc., worth $15.1 million, in the quarter prior.

The two exits, coupled with falling share prices in the REIT sector overall, brought down AEW’s total holdings to $2.39 billion in 44 publicly traded REITs as of Sept. 30 from $2.60 billion in 46 REITS as of June 30, according to the company’s latest Form 13F filing.

Bolstered positions

AEW increased its position in Healthpeak to $22.1 million as of Sept. 30 from $2.1 million three months before. Healthpeak is in the process of buying fellow healthcare REIT Physicians Realty Trust in an approximately $21 billion all-stock merger of equals.

AEW’s position in Alexandria Real Estate soared to $34.8 million from $4 million. The Pasadena, Calif.-based office REIT is bullish about the prospects of AI and machine learning as emerging drivers for laboratory space demand.

Dropped positions

AEW gave up its stakes in Boston Properties, which reported funds from operations of $292.8 million, or $1.86 per share, in the third quarter, down from $299.8 million, or $1.91 per share, a year ago. The office REIT attributed the decline primarily to increased interest expenses.

Life Storage was acquired by Salt Lake City, Utah-based peer Extra Space Storage Inc. in July. AEW cut its stake in Life Storage by over 60% in the second quarter.

Top holdings

Industrial REIT Prologis Inc. topped AEW’s holdings in the third quarter, at $274.4 million, despite the asset manager selling off 3% of its position during the period. Datacenter-focused Equinix Inc. was a close second with a $223.9 million stake as of Sept. 30.

Multifamily REIT AvalonBay Communities Inc. came in third with AEW’s share amounting to $136 million.

Physicians Realty was AEW’s smallest position as of Sept. 30. AEW sold nearly its entire stake in Physicians Realty, down to just under $500,000 as of Sept. 30.

Biggest positions by sector

Residential REITs accounted for AEW’s biggest holdings as of Sept. 30, at $589.2 million, or nearly a quarter of the asset manager’s total positions during the period.

Specialty REITs were AEW’s second-biggest position by sector in the third quarter, with about a fifth of the asset manager’s total holdings, beating industrial REITs, which represented about 16% as of Sept. 30.

Retail REITs stayed the investor’s fourth-biggest position by sector.

Healthcare REITs edged off self-storage REITs from AEW’s fifth-biggest position by sector.

Read Nore:AEW Capital ups stakes in Healthpeak, Alexandria; drops Boston Properties